South Carolina COVID-19

Response & Resources

This page is updated regularly and reflects the latest known information by South Carolina Appleseed. If you see information that needs to be updated, please email [email protected]

South Carolina COVID-19 Resources & Response (Idioma español aquí)

In the wake of school closure, economic shock and other unseen impacts of the COVID-19 pandemic, Appleseed has created a comprehensive database for South Carolina families searching for answers about food access, housing, consumer protection, healthcare and other developments. The page will also inform users of the evolving situation around the suspension of evictions in South Carolina. As this crisis evolves, with an uncertain amount of new policies coming from federal, state and local officials, this page will relay the most current and relevant information in an easily accessible way.

These resources will be found in both English and Spanish.

This page also provides statewide information about benefits and services as it becomes available. If you have information that you believe will help those facing the challenges of COVID-19 please share with us and we will do our best to include it on our resource page

Access to COVID-19 Testing and Treatment

To find information about how to keep you and your family safe from COVID-19, visit the Department of Health and Environmental Control (DHEC)’s website.

*To access the DHEC website in Spanish or other language click on the world icon on the upper center of the page. Click on “Select Language”, and click on “Spanish” or relevant language.

If you need to get a COVID-19 test or virtual screening you can visit the DHEC website for a list where you can get tested and screened. If you do not speak English, you have rights when getting testing or screening online or by telephone for COVID-19. You have the right to an interpreter and to get written information in a language you understand.

*To access the DHEC website in Spanish or other language click on the world icon on the upper center of the page. Click on “Select Language”, and click on “Spanish” or relevant language.

Benefits & Community Food Resources

U.S. citizens and some immigrants can qualify for Supplemental Nutrition Assistance Program (SNAP) benefits, even if other people in your family are not eligible. There are no public charge problems for eligible people, like the U.S. Citizen children, to get SNAP and other government benefits because benefits used by your family members cannot count against you in the public charge test. To get SNAP, you can apply for SNAP and other benefits online in English and in Spanish.

To apply for SNAP online in Spanish, click on “ES” in the right corner. You can get assistance in English through the SC Thrives and in Spanish by calling Lulu Hernandez from PASOs at 803-605-4685.

SNAP Benefits have increased for the COVID-19 Pandemic. Here's what you need to know:

- This benefit will continue through the end of 2021

- You will get the highest monthly SNAP amount allowed for your family size

- Unfortunately, SNAP households already receiving the highest amount will not get more SNAP

- This will go directly onto EBT cards; you do not need to ask DSS to do this

- March increase should go onto EBT cards within the next few days

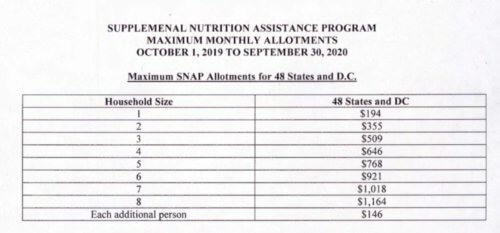

**Here is the USDA’s SNAP Highest Monthly Amount by house size:

Find info on the emergency SNAP supplement here. https://dss.sc.gov/news/dss-announces-emergency-supplement-for-snap-households/

The ABAWD Work Condition for Adults Without Dependents is Stopped, South Carolina’s work requirement for some adults to keep on getting SNAP past three months will be stopped until further notice.

- If you lost SNAP benefits due to the time limit you should reapply for SNAP

- TANF work conditions will also not be required during this time period

SNAP Recertification Delayed

- SNAP households who are due to recertify will not need to do so. DSS will not be mailing out recertification paperwork for these months

If you did not make the deadline, notify DSS immediately by calling your local DSS office and asking for your SNAP case to stay open.

The South Carolina Department of Social Services recently learned of a possible phishing scam in an attempt to acquire personal identifying information from individuals perceived to be recipients of federal benefit programs such as the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF).

Scammers have reportedly contacted individuals via email posing as a company that can reimburse your SNAP purchases. This is not legitimate.

Please do not provide any bank account information or SNAP/TANF ID information. SCDSS is working with the proper authorities to address the matter.

In some situations, DSS employees may request South Carolina residents confirm personal information over the phone, but staff will never threaten clients for information or request bank account information.

The United States Department of Agriculture (USDA) reminds us: “USDA Does Not Tolerate Attempts to Use Social Media to Facilitate Fraud. Please report any incidents of email ‘phishing’ attempts to fraudulently gain access to recipient SNAP EBT account information to the SC Department of Social Service, Office of Inspector General Fraud Hotline at 1-(800) 694-8518.”

You can also make a report of any suspicious phone calls or emails to DSS by contacting [email protected]

South Carolina Appleseed is Developing a list of food resources for seniors by county. It can be found in English here. En Espanol

South Carolina Senior Food Resources / Recursos Alimentarios para mayores de Carolina del Sur

Senior Resources releases a new plan to cover emergency senior feeding services. It covers all normal clients currently enrolled in their Meals on Wheels program and will help all senior citizens in Richland County during the COVID-19 crisis.

Starting Monday, March 23, Senior Resources will be giving any senior citizen in Richland County five free meals per week. This will be first come, first serve basis, at four locations throughout the county.

Drive thru service will be offered for meal pick-up from 10:30 a.m. to 12:00 p.m. Mondays, Wednesdays and Fridays. Each vehicle will be permitted to pick up two meal packs which will include five meals per pack.

To get the meal pack, you must be 60+ or picking up a meal to take to a senior citizen. All people picking up meals must show a state issued id and give a name, address and phone number at pick-up. Only one meal pack is allowed per person with a maximum of two meal packs per car. Individuals are only permitted one pick-up per week.

You can find information about this program at Senior Resources: www.seniorresourcesinc.org

Pick-up locations can change week-to-week, so check each week on locations. Right now, there are four sites, three days a week. This could increase to include afternoon meal pick-ups at certain locations. It is important to check back at the beginning of each week for the latest information.

If you can’t check for locations on the internet, you can call our office (803) 252-7734 or the United Way helpline (2-1-1) for the latest on meal pick-up locations.

What is Pandemic EBT: Eligible South Carolina households will receive a food assistance boost through a new federal program called Pandemic EBT (“P-EBT”). P-EBT provides food assistance dollars to families with school-aged children who lost access to free or reduced-price school meals because of the pandemic-related school closures this spring. Eligible families will receive money on a new or existing EBT card to help fill the school meals gap. The average benefit will be $5.70 per day, per child, which for South Carolina students will total approximately $330. The P-EBT benefit will be provided as a one-time payment, meant to reimburse families for food assistance lost during March 16th-June 10th.

Who is Eligible: Students who receive free or reduced-price school meals when schools are open are eligible to receive the P-EBT benefit. This includes all students who attend schools participating in “CEP,” in which all students receive free school meals. Private and charter school students may be eligible for P-EBT if their school participates in the National School Lunch Program.

How to Access P-EBT: Families who participate in the Supplemental Nutrition Assistance Program (“SNAP”) will receive their P-EBT benefit directly to their EBT card. Eligible families who do not already participate in SNAP will receive a new P-EBT card in the mail, with a letter explaining P-EBT. The P-EBT card works like a debit card to purchase food items anywhere EBT benefits are accepted.

P-EBT and Public Charge: Eligible South Carolina students may participate in P-EBT regardless of citizenship/immigration status, and there is no public charge consequence for participating in P-EBT.

Thank you! The SC Department of Social Services and the SC Department of Education have collaborated to implement P-EBT in South Carolina; thank you for all your hard work!

The following is a list of food banks across South Carolina. Please click on the link to find out more information and see where the nearest location to you is.

Low County Food Bank

Low Country Food Bank serves the Charleston area and has over 200 partner pick-up sites across 10 low country counties. To find the pick-up site closest to you, go to this link and type in your address or zip code. Requirements, hours, and availability will vary by partner site. You are encouraged to call before going to any partner site location.

Harvest Hope Food Bank

Harvest Hope Food Banks are located in Greenville, Columbia, and Florence. Each food bank location has over 100 partner pick-up sites. You can enter your zip code at this link, and it will show you the partner pick-up locations in your area. Requirements, hours, and availability will vary by partner site. You are encouraged to call before going to any partner site location.

Golden Harvest

Golden Harvest is located in Aiken, has 175 partner pantries across 25 counties, and is hosting mobile markets in various impacted communities. Go to the link and type in your zip code to find the one closest to you.

To receive services from a partner pantry, you may be asked to self declare that your income has been interrupted or falls within federal guidelines. Some may ask to confirm an address or zip code because they only serve certain geographic areas. Golden Harvest partner sites have a variety of grocery items including fresh produce, and anyone is eligible to receive services. Hours and availability will vary by partner site. You are encouraged to call before going to any partner site location.

Golden Harvest hosts a hot meal at 702 Fenwick St, Augusta GA 30901 Monday-Saturday at 11am and Sunday at 1pm. There are no requirements to receive this service, anyone is welcome.

Second Harvest

Second Harvest food bank serves nine South Carolina counties including York, Union, Spartanburg, and Pickens County. To find a partner site nearest to you, visit the link and type in your zip code. Requirements, hours, and availability will vary by partner site. You are encouraged to call before going to any partner site location.

South Carolina 211 Pantry Finder:

South Carolina 211 is a comprehensive database of food pantries across South Carolina. Go to the link and type in your zip code to find a food pantry near you!

Get Care SC:

Get Care SC is a database of resources for South Carolinians who are experiencing a disability, are a caregiver, or are a senior citizen. Go to the link and type in your zip code to find food assistance near you!

No Empty Bowls Pet Food Pantry:

Greenville County Animal Care is offering a pet food bank to help families that might be struggling financially. We know many people will feed their pets before they feed themselves and that is not necessary. If you’re a Greenville County citizen struggling to make ends meet, we’re here to help you keep your pet’s bowl full.

Monday-Friday

Noon-7pm

Lost & Found Building

Saturday

11am-6pm

Adoption Lobby

If you have children under 5 or are pregnant, you may be eligible for the Special Supplemental Nutrition Program for Women, Infants and Children (WIC). WIC is a program that gives food vouchers and nutrition education to pregnant women, women who are breastfeeding, and children under 5.

There has been a Temporary Cash Value increase to $35 for participants for Fruits and Veggies only valid for June 1, 2021 through September 30, 2021.

There are no immigration status rules for WIC and it does not count under the public charge rule. You can apply for WIC by calling 1-855-4-SCDHEC (1-855-472-3432). If you need help applying in English or in Spanish, call Lizabet Herranz from PASOs at 803-807-6748.

The South Carolina Women, Infants, and Children (WIC) team is working to make sure you can use your WIC benefits during the COVID-19 pandemic. We know that the shelves in your local grocery stores are low on items. You can buy smaller amounts if needed.

If you see gallons of milk are running low or out at your grocery store, you can buy half-gallons of milk. If you are unable to buy 16 oz. cheese, you can buy 8 oz. cheese.

If you are unable to buy your WIC approved cereal in the following sizes:

- 12 oz. • 18 oz. • 36 oz.

You can purchase a 9 oz. or 24 oz. cereal.

We appreciate our WIC participants and we are doing everything to provide WIC benefits during these challenging times.

Lifeline is a federal benefit that helps lower the cost of phone and internet service. The Emergency Broadband Benefit Program is a Federal Communications Commission (FCC) program that provides a temporary discount to monthly broadband bills, providing up to $50 off your phone and internet bill and a one-discount of up to $100 for a laptop, tablet, or discount computer.

If you qualify for programs like SNAP or Medicaid, it is likely you also qualify for Lifeline and the Emergency Broadband Benefit Program.

You can sign up for both programs here: https://www.checklifeline.org/lifeline

Unemployment Insurance & Financial Assistance

INFORMATION FOR EMPLOYEES

- Effective June 26, 2021, the state of South Carolina is no longer participating in any of the federal pandemic unemployment programs. This includes PUA, PEUC, FPUC, and MEUC.

- If you are eligible to move from federal programs to the state UI program, you will be notified with next steps. Continue checking your MyBenefit Portal: https://www.dew.sc.gov/covid-19-resources

- Anyone currently on state unemployment benefits, which is up to 20 weeks of benefits, will continue to receive their weekly benefit amount (WBA) starting June 27, 2021 as long as they remain eligible.

- As of April 18, 2021, the work search requirement is in effect. You must complete two weekly job searches in the SC Works Online Services (SCWOS) portal each week to remain eligible for UI benefits.

- This is updated and no longer waived because of COVID 19.

- Portal link: https://jobs.scworks.org/vosnet/Default.aspx

- Weekly benefit ranges from $42 to $326 a week before taxes

- If COVID-19 made your employer lay you off or reduce your hours, you can get help. You can apply for UI through the SC Department of Workforce and Employment SCDEW. If you’re applying for UI between March 15 and April 18, the process has changed. You will not have to wait a week or do two job searches per week to receive benefits.

IF YOU BELIEVE YOU WERE LAID OFF OR FIRED BECAUSE YOU TESTED POSITIVE FOR COVID-19 (THE CORONAVIRUS)

- You can file a complaint with the Human Affairs Commission or the federal Equal Employment Opportunity Commission.

More info on how to apply here.

For Employers:

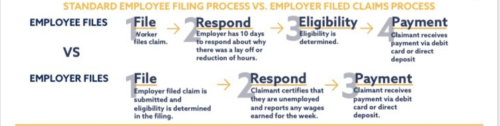

What is an “Employer-filed claim” and how do they work?

When an employer files the claim with SCDEW it is a way for workers who have been laid off or have reduced hours but are still “job attached” to the employer, to possibly receive Unemployment Insurance benefits (UI).

What does “job attached” mean?

Being job attached to an employer means that both the employee and employer intend that (s)he will go back to work or increase their hours in the future. This means the worker has not left work permanently.

Is this a better way to apply for unemployment insurance?

Employer filed claims are more useful as it removes the step of an employer having to verify a worker’s claim. Employers can use an excel spreadsheet or CSV file to upload many employees at once instead of one at a time. Initial claims are filed online through the MyBenefits portal. If you need further assistance call our toll-free number 1-866-831-1724 | Relay 711.

Do I need to do anything different for furloughed employees?

Yes! You need to submit a Support Payment Plan Application found at https://www.dew.sc.gov/employers/covid-support-payments. The application is in the bottom left corner of the web page.

How does an employer file an employer-filed claim?

Use the Employer Self Service Portal: https://scuihub.dew.sc.gov/ESS/ESSLogin.htm?service=%2F

When can an employer submit a claim?

- The employer must submit an electronic file to our department each week he/she wishes to file by using the Employer Self-Service Portal. The claim must be submitted after the week of layoff is over but within 14 days of the claim week ending date.

- An employer is required to report any earnings the employee may have received from employer or any other employer during the particular week filed.

- An employer is allowed to file up to six weeks for affected employees. Employees are exempt from work search requirements during those six weeks.

More info: https://www.dew.sc.gov/employers/employer-filed-claims

If I make an employer-field claim, should I tell my employees?

Yes. If you make an employer filed claim on behalf of your employees, tell them. The worker will still need to apply for UI. You can tell him/her to create an account and certify the claim each week on the SCDEW website.

Employer-Filed Claims Process Has Less Steps

Source: SCDEW as of March 23, 2020

For more information, visit the SCDEW website at https://dew.sc.gov/

For Employees:

If the business files an employer claim, do I need to do anything to get UI?

Yes! You will still need to go to the SCDEW website at https://dew.sc.gov/ and set up an account and make a claim. You will need to file each week out of work or you have reduced hours

If you are new to the SCDEW system, l click the “I am new here. I need to register now!” This is a three-step process:

- Create a username and password; then

- Log into the system using their new name and password to create an account

- After creating an account, you will need to CERTIFY your weekly claims to receive unemployment benefits.

IMPORTANT:

If you have applied for UI before on the computer system, you should use the same username and password used last time to login and certify. If you do not remember your username and password. Do Not create a new account. Instead, click “forgot your username/password.”

Can I still get UI if I’m a furloughed employee?

- Every claim is different and there are many factors that play into what makes someone ineligible. To determine if you are eligible to receive UI benefits, you must file a claim with DEW.

- Situational requirements:

- You’re unemployed. (If you currently work less than full time due to being out of work and earn less than your weekly benefit amount, you’re still considered unemployed. When filing your weekly claim, report all work you performed and wages earned that week. Continue to seek full-time work.)

- It was not your fault you lost your job from your most recent employer.

- You're able to work.

- You’re available for work and willing to take any suitable offer.

- You report to your local comprehensive SC Works center as required. (Temporarily suspended due to COVID-19)

- You must actively search for suitable work each week that you file a weekly certification for unemployment insurance benefits. Suitable work includes any trade, occupation, or business in which you are qualified based on your training or experience, and which pays at least 90% of your previous salary during your first eight paid weeks of unemployment and 75% of your previous salary after eight paid weeks of unemployment.

- You must complete at least two (2) work searches through SC Works Online Services (jobs.scworks.org) each week that you file a certification.

- Monetary Requirements:

- Monetary requirements only apply to claimants on state UI not on the federal program, Pandemic Unemployment Assistance (PUA).

- To be monetarily eligible for (state) UI benefits, you must:

-

- Have at least $1,092 in covered employment (with an employer who paid UI taxes) during the base period’s* highest quarter.

- Have earned at least $4,455 from covered employment during the base period*.

- Have total base period* wages that are equal to, or exceed, 1.5 times the high quarter wages’ total.

*The base period is defined as wages earned doing one year of insured work. Base-period wages typically establish monetary eligibility for UI benefits. There are two methods used when calculating the base period: the standard base period and the alternate base period, both described below. When your initial claim is reviewed, DEW will decide which base period system your situation falls under. You will not have to determine this yourself.

Source: https://www.dew.sc.gov/individuals/how-unemployment-insurance-works

Here are some tips for answering questions while filing your initial claim.

Q: Who do I list as an employer if I’m self-employed, 1099, gig employees, etc.?

A: Use the name you provide when filing with the IRS.

Q: Why is it asking if I have completed a job search since the weekly job search was waived for COVID19 related claims?

A: To remain eligible for UI, you must complete the job search requirement: Starting April 18, 2021, the job search requirement in SCWOS (SC Works Online Services) will begin. Claimants are required to complete two weekly job searches in SCWOS in order to remain eligible for Unemployment Insurance benefits. The state regulation that requires this was suspended for more than one year during the pandemic.

Q: What is my return to work date if I don’t know?

A: Use your best guess. This can be changed later.

NOTE: If you have lost your job, through no fault of your own, due to COVID19, please use COVID-19 as the reason for the layoff.

The U.S. Small Business Administration (SBA) has approved Governor Henry McMaster’s request for the agency to offer South Carolina’s small businesses with disaster assistance. Governor McMaster requested the disaster declaration in a March 17 letter to SBA Administrator Jovita Carranza.

The disaster declaration means that South Carolina’s small businesses that have suffered substantial economic injury as a result of the COVID-19 virus may qualify for low-interest federal disaster loans. All 46 counties are included in the disaster declaration.

“These low-interest loans are of monumental importance to our business community," said Gov. Henry McMaster. "There's no doubt that our state's small businesses have suffered losses throughout this incredibly difficult time, but help is on the way. To have Administrator Carranza approve our request so quickly shows that President Trump’s administration is fully committed to helping our businesses recover from the impact of this virus.”

South Carolina’s businesses can apply online at: https://disasterloan.sba.gov/ela.

For additional loans, visit here: https://www.sba.gov/funding-programs/loans/covid-19-relief-options

Advance Child Tax Credit

The expanded and newly-advanceable Child Tax Credit was authorized by the American Rescue Plan Act, enacted in March. Normally, the IRS will calculate the payment based on a person's 2020 tax return, including those who use the Non-filer Sign-up tool. If that return is not available because it has not yet been filed or is still being processed, the IRS will instead determine the initial payment amounts using the 2019 return or the information entered using the Non-filers tool that was available in 2020. If an eligible taxpayer did not file for 2019 or 2020, they may use a new online Non-filer Sign-up tool to register for the monthly Advance Child Tax Credit payments.

To make sure families have easy access to their money, the IRS will issue these payments by direct deposit, as long as correct banking information has previously been provided to the IRS. Otherwise, people should watch their mail starting on or after July 15 for their mailed payment. The dates for the Advance Child Tax Credit payments are July 15, August 13, September 15, October 15, November 15 and December 15.

- Link for the Non-filer Sign-up tool: https://www.freefilefillableforms.com/#/fd/childtaxcredit

- Use this tool to report your qualifying children born before 2021 if you:

- Are not required to file a 2020 tax return, didn’t file one and don’t plan to; and

- Have a main home in the United States for more than half of the year.

- Also, if you did not get the full amounts of the first and second Economic Impact Payment, you may use this tool if you:

- Are not required to file a 2020 tax return, didn’t file and don’t plan to, and

- Want to claim the 2020 Recovery Rebate Credit and get your third Economic Impact Payment.

-

-

- What you need for this tool:

- Full name

- Current mailing address

- Email address

- Date of birth

- Valid Social Security numbers (or other taxpayer IDs) for you and your dependents

- Bank account number, type and routing number, if you have one

- Identity Protection Personal Identification Number (IP PIN) you received from the IRS earlier this year, if you have one

- What you need for this tool:

-

- For more information: https://www.irs.gov/credits-deductions/advance-child-tax-credit-payments-in-202=

For the most up-to-date information, please visit this link regarding stimlus checks.

Stimilus Check FAQ

The Treasury Department and the Internal Revenue Service today announced that delivery of payments from the government will start in the next three weeks. They will be issued automatically. Most people will not have to do anything to get money. Direct deposits should begin by April 17, followed by checks in the mail.

Who is eligible for the economic impact payment?

Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing together will get the full payment. If your income is above those amounts, your payment is lowered by $5 for each $100 above the $75,000/$150,000. Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible.

Eligible taxpayers who filed tax their taxes in 2019 or 2018 will automatically get this payment up to $1,200 for individuals or $2,400 for married couples. Parents also receive $500 for each eligible child.

You may include a foster child, If you are a foster parent and the child lived with you half the year. The child cannot be claimed by the birth parent.

How will the IRS know where to send my payment?

Most people do not need to do anything. The IRS will calculate and send the payment to those who are eligible.

The third stimulus check is based on your 2020 tax return. If a 2020 tax return has not been processed when eligibility and amount of payment are being determined for you, your 2019 tax information may be used for this purpose. If eligible, you may claim a 2021 Recovery Rebate Credit for the dependent on your 2021 tax return that you will file in 2022.

Banking information is received in a number of ways:

-

- Your bank account information is obtained from the most recently filed tax return or information entered in Get My Payment. You cannot change your account information.

- If you haven't filed a 2020 or 2019 tax return and you received SSA, RRB, SSI, or VA benefits, you will receive the third payment as a direct deposit, on your Direct Express Card, or by mail, just as you would normally receive your benefits

When there is no banking information available, before issuing a U.S Treasury check or EIP Card, Treasury's Bureau of Fiscal Service has provided IRS account information from agencies issuing benefit payments including the Office of Personnel Management, Railroad Retirement Board, Social Security Administration, Thrift Savings Plan, and Department of Veterans Affairs. The banking information can be either where a U.S. Government payment was sent or an account where an individual paid the U.S. Governmen=

What can I do to get my direct deposit information to the IRS?

Treasury plans to develop a web-based portal on its internet site for individuals to provide their banking information to the IRS online. This will let you get payments immediately as opposed to checks in the mail.

I am on Social Security or Social Security Disability and do not file a tax return. Can I still get my payment?

People who usually do not file a tax return because you get Social Security or Social Security Disability will not need to file anything to get the payment. Senior citizens, Social Security recipients, some veterans and individuals with disabilities who are otherwise not expected to file a tax return will not owe tax.

The IRS will automatically send a third payment to people who didn't file a return but receive Social Security retirement, survivor or disability benefits (SSDI), Railroad Retirement benefits, Supplemental Security Income (SSI) or Veterans Affairs benefits. Social Security and other federal beneficiaries will generally receive this third payment the same way as their regular benefits. The IRS is working directly with the other federal agencies to obtain updated 2021 information for recipients to ensure we are sending automatic payments to as many people as possible.

While payments will be automatic for beneficiaries based on their federal benefits information, some may need to file a 2020 tax return even if they don't usually file to provide information the IRS needs to send a payment for a spouse or any qualified dependent(s). People in this group should file a 2020 tax return to be considered for an additional payment for their spouse and qualifying dependent(s).

I only get SSI or VA Disability Compensation and do not file a tax return. Can I still get my payment?

Yes, but you must file a tax return. Low-income seniors and people with disabilities who get only Supplemental Security Income (SSI), Veterans (VA) Disability Compensation or Veterans Pension benefits must file a tax return in order to get their stimulus payment.

I have not filed my tax return for 2018 or 2019. Can I still get an economic impact payment?

Yes. Anyone who is supposed to file your taxes but has not filed for 2018 or 2019 needs to do so as soon as they can. This is how you can get an economic impact payment. Taxpayers should include direct deposit banking information on the return.

I need to file a tax return. How long are the economic impact payments offered?

If you need to get help filing and will need in person help to file your tax return, these payments will be available all through the rest of 2020.

I am an Immigrant, Can I Get This Payment?

Immigrants may be eligible. This is what you need to know as an immigrant:

- You must have a valid social security number. Sadly, this will stop many immigrants and mixed–immigration status families from getting this help.

- Eligibility for immigrant families is limited:

- Individual tax filers must have a social security number that is legitimate for work purposes when you file your 2020 tax return.

- There is an exception. If at least one spouse filing jointly was in the military during the last tax year, and if one spouse has a valid social security number

- To get the funds, tax filers will also need to be “resident aliens”. This means if you are not a U.S. citizen or lawful permanent resident (LPR), you live primarily in the United States.

- Children claimed as dependents must also have a lawful social security number for your family to get the funds for dependents. If the dependent is not a U.S. citizen or lawful permanent resident (LPR), they must also be resident alien.

- People who file taxes using an Individual Taxpayer Identification Number (ITIN) will not be able to get payment. If both spouses in a married couple used an ITIN to file their taxes, no one in the household is eligible. This is even if you have dependent children with social security numbers.

- For mixed–immigration status married taxpayers (where one taxpayer has a social security number and the other taxpayer has an ITIN), you must file separately to claim the payment for any household members with a social security number.

- Mixed status couples who file jointly and receive health insurance tax subsidies under the Affordable Care Act may not be able to file separately. This is because they might lose their health insurance tax subsidy. We urge you to consult a tax professional before you file anything.

If you don’t normally file a tax return, you can still receive a stimulus check. To do so, enter your information into this portal. Or for more information, click here.

What if I did not get a full Economic Impact Payment?

- If you didn't get a first and second Economic Impact Payment or got less than the full amount, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return. Alternatively, eligible people who don't normally have to file a tax return and who didn't file a 2019 or 2020 tax return or use the Non-Filers tool for stimulus payments last year can use the Child Tax Credit Non-filer Sign-up Tool. You can still file after the tax deadline

Where can I get more information?

The IRS will post all vital information on IRS.gov/coronavirus as soon as they have it. The IRS has a cut staff in many of its offices but remains devoted to helping eligible individuals receive their payments as fast as possible.

Check for updated information on IRS.gov/coronavirus rather than calling IRS assistors. They are helping process 2019 returns.

The COVID-19 epidemic has harshly impacted undocumented workers. Undocumented workers in the state are not eligible for unemployment benefits (UI). These families are facing hard financial situations. There are national groups that have funds to help undocumented workers and their families. Below is a list of funds that are available to undocumented workers in South Carolina.

National Resources:

Restaurant Workers’ Community Foundation: Southern Smoke Application for Financial Assistance

- This fund provides funding to those employed by or own restaurants or bars or will not be covered by insurance

- Apply: https://form.southernsmoke.org/smoke/application/

La Cosecha: Undocumented Workers Fund

- This fund is to help the immigrant community during COVID-19. The fund will help

- families buy groceries, pay rent, utilities, and other monthly bills.

- Apply: https://secure.actblue.com/donate/cosechamutualaid?refcode=march22email&link_id=2&can_id=f1f6583ae991bfd4ec74b2c7066277e7&source=email-donate-to-the-undocumented-worker-fund&email_referrer=email_756635___subject_1012348&email_subject=donate-to-the-undocumented-worker-fund

One Fair Wage: One Fair Wage Service Worker Emergency Fund

- Fund is to help workers who work in the service industry

- Apply: https://ofwemergencyfund.org/ayuda?fbclid=IwAR2JzeI0SaWHZ-N0uH9cJXc1U3FsynnlNabz0W9NgXjKWrx_h1HiQHvBHFU

Restaurant Opportunities Centers United: ROC Relief

- Fund helps restaurant workers affected by the pandemic of COVID-19

- Apply: https://rocunited.org/relief/

The federal government is giving stimulus payments to families to help support people during the national COVID-19 emergency. Only some immigrants are eligible for these payments.

Below are some frequently asked questions about who can get these payments if you, or one of your family members, is an immigrant.

If I am an immigrant with no spouse and no children, can I get the payment?

It depends. If you file your taxes with a social security number that was issued for work purposes, you can get the payment. You must also be either a U.S. citizen, Lawful Permanent Resident (LPR), or a “resident alien,” meaning you reside in the U.S. most of the time. If you file your taxes with an Individual Taxpayer Identification Number (ITIN), you cannot get the stimulus payment.

I have a social security number and I file taxes as “married filing jointly” with my spouse who has an ITIN, and we don’t have any children, can we get the payment?

You alone will qualify, unless you or your spouse is in the military. The third stimulus check is different than previous checks. If you are married filing jointly, and one spouse has an SSN and one has an Individual Taxpayer Identification Number (ITIN), the spouse with an SSN can get the payment. If one spouse is an active member of the military, then both spouses are eligible for a stimulus check even if only one spouse has an SSN and the other spouse has an ITIN.

Originally, under the first stimulus check, if you were married filing jointly, both spouses needed valid SSNs. However, expanded SSN rules for the second stimulus check are retroactive and now apply to the first stimulus check. If you were denied your first stimulus payment because both you and your spouse did not have SSNs, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return.

Information here: https://www.irs.gov/newsroom/recovery-rebate-credit

My spouse and I both have ITINs, but our children have social security numbers, can we get the payment?

Any family member that has a Social Security number (SSN) can qualify for the third stimulus check. In a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents do.

I have a social security number and I file taxes as “married filing jointly” with my spouse who has an ITIN, but our children have social security numbers, can we get the payment? No,

You and your children may qualify for the stimulus check. If you are married filing jointly, and one spouse has an SSN and one has an Individual Taxpayer Identification Number (ITIN), the spouse with an SSN and any qualifying dependents with SSNs or Adoption Taxpayer Identification Number (ATIN) can get the payment. If one spouse is an active member of the military, then both spouses are eligible for a stimulus check even if only one spouse has an SSN and the other spouse has an ITIN.

Originally, under the first stimulus check, if you were married filing jointly, both spouses needed valid SSNs. However, expanded SSN rules for the second stimulus check are retroactive and now apply to the first stimulus check. If you were denied your first stimulus payment because both you and your spouse did not have SSNs, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return.

If me and my kids have a social security number, but my spouse has an ITIN, is there any way I can get the individual payment for myself and my kids?

Only people with valid Social Security numbers will be eligible to receive a stimulus payment. That means undocumented immigrants and immigrants who file their taxes with an Individual Taxpayer Identification Number (ITIN) are not eligible for a payment. However, a family member having an ITIN will not disqualify an entire family.

If you file jointly with your spouse and only one individual has a valid SSN, you will receive up to $1,400 for the spouse with a valid SSN and up to $1,400 for each qualifying dependent claimed on the tax return.

You can still receive up to $1,400 for a qualified dependent claimed on your return, even if one member of a family does not have a valid SSN, but you must meet all of the other eligibility and income requirements.

My spouse and I are here on work visas and we have social security numbers, but our children have ITINs, can we get the payment?

You will receive up to $1,400 for each spouse with a valid SSN and up to $1,400 for each qualifying dependent claimed on the tax return. The third payment includes up to an additional $1,400 for each dependent you claim on your 2020 tax return (or your 2019 return if a 2020 return has not been filed or processed) with a valid SSN or Adoption Taxpayer Identification Number issued by the IRS.

A child is your qualifying child if the following conditions are met:

-

- Relationship to the individual who’s eligible for the payment: The child is your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of any of them (for example, grandchild, niece, or nephew).

- Child's age: The child was: under age 19 at the end of the tax year, under age 24 at the end of the tax year, a student, and younger than you, or any age and permanently and totally disabled.

- Child's citizenship: The child’s a U.S. citizen, U.S. national, U.S. resident alien, or a resident of Canada or Mexico.

- Child's residency: The child lived with you for more than half of the tax year.

- Support for child: The child didn’t provide over half of his or her own support for the tax year.

- Child's tax return: The child doesn’t file a joint return for the year (or files it only to claim a refund of withheld income tax or estimated tax paid).

If I get this payment, can it be used against me in the public charge test if I adjust my immigration status in the future?

No. The stimulus payment is a tax credit. The law is clear that tax credits will not count in a public charge determination. Also, if you are already an LPR, there is no public charge test when you apply to adjust to U.S. citizenship.

Housing Protections

On August 26, the Supreme Court ruled in a 6-3 vote to end the Eviction Moratorium that was originally set to end on October 3rd. This means that all protections from the moratorium have been eliminated.

“We are disappointed that the stay has been lifted and implore the Governor and Legislature to take immediate action by encouraging the landlord community to work with tenants as they are trying to access the rental assistance funds, and go a step further and reconvene to issue a stay during these very dangerous times.” – Sue Berkowitz, Director of SC Appleseed Legal Justice Center

If you are in need housing assistance, please visit our Housing Resource Page.

The SC Stay Plus program may be able to help pay up to 12 months of late rent and/or utilities for folks who have been affected by Covid-19.

Applications are open now and may be submitted online or by calling 803-336-3420.

Before you apply try to collect the following:

- Pictures or scans of a photo identification (driver’s license, passport, etc.);

- A copy or picture of your signed lease, or proof of rent payments (i.e., a bank account statement with confidential information removed) if a signed lease is not available;

- A 2020 Federal Tax Return (1040/1040EZ or equivalent) or pay stub from the last 60 days. (Please note that only the first two pages of a tax return are required);

- Proof of financial hardship, such as proof of unemployment from the S.C. Department of Employment of Workforce (DEW) (i.e., website screenshots or confirmation letters from DEW), OR proof of lost wages (i.e., a layoff notice, an unemployment letter, proof of business closure; AND

- Proof of risk of housing loss or experiencing homelessness, such as an eviction notice OR a past due notice for rent or utilities.

You may still apply if you do not have these items.

Please note: If you previously applied for the SC Stay rental assistance program in February 2021, please be aware that you cannot request support from both programs for the same period of back rent. However, you can request assistance for different months.

Important Note: Residents of Anderson, Berkeley, Charleston, Greenville, Horry, Richland, or Spartanburg counties are not eligible for this program. The following seven counties received other funding and will provide their own rental assistance programs: Anderson, Berkeley, Charleston, Greenville, Horry, Richland and Spartanburg. Please visit the SC Housing website for a list of rental assistance programs in your area.

You have a right to not be discriminated against because of your race, color, national origin or immigration status, religion, sex, familial status or disability race. If you think your landlord is discriminating against you, you can call the SC Commission on Human Affairs. They have Spanish speaking staff who will help you and investigate any allegations of discrimination. You can contact Grisel Jackson at 803-737-7803 or [email protected], or Carlos Diaz at (803) 612-9112 or [email protected]. Undocumented immigrants are also protected from discrimination in housing and you can learn more those protections here

Foreclosures Put on Hold and Homeowner Assistance

Several things will slow down foreclosures that have started and may help homeowners who are having trouble making their mortgage payments escape foreclosure completely. What's important to know is that:

- Most homes are protected from foreclosure through at least July 31, 2021.

- Most homeowners now have until at least June 30 to sign up for forbearance, a way to temporarily lower or pause mortgage payments.

- And if you're enrolled in a federal forbearance program you may be able to extend that protection for several months.

To learn if you're eligible for these protections, how to get them, and which deadlines apply to you, visit consumerfinance.gov/housing.

FOR ALL HOMEOWNERS

All pending foreclosure cases in South Carolina have been put on hold.

On March 18, 2020, the South Carolina Supreme Court suspended all foreclosures including hearings, sales, and evictions. We don’t know how long this suspension will last. The South Carolina Supreme Court will have to lift the suspension.

If you have been served with foreclosure papers or if there are other deadlines in your case, you should still meet those deadlines. People served with foreclosure papers usually have 30 days to respond. If you don’t respond in that time, you can lose many of your rights.

FOR OWNERS OF MANY SINGLE-FAMILY HOMES

HUD has put on hold foreclosures of FHA-insured single-family mortgages through September 30, 2021.

FHA mortgages usually require lower down-payments than other kinds of mortgages. Many lower- and middle-income families achieve reach the goal of homeownership with FHA loans. If you’re not sure whether you have an FHA loan, check with your lender.

Fannie Mae and Freddie Mac have suspended foreclosures of all single-family mortgages. No deadline currently.

Fannie Mae and Freddie Mac back about one half of all mortgages in the United States, so not all homeowners will be covered by this. To find out if you are covered, you will need to contact Fannie Mae and/or Freddie Mac to see if either one guarantees your mortgage. You can find contact information for them HERE.

Your initial forbearance plan will typically last 3 to 6 months. If you need more time to recover financially, you can request an extension. For most loans, your forbearance can be extended up to 12 months. Some loans may be eligible for up to 18 months of forbearance, depending on when your initial forbearance started.

Fannie Mae and Freddie Mac have announced that homeowners may be able to get relief from mortgage payments for up to 12 months.

Again, this covers about one half of all mortgages, so not everyone is covered.

The United States Department of Agriculture (USDA) has stopped foreclosures of some mortgages through June 30, 2021.

This applies to the USDA Single-Family Housing Guaranteed Loan Program (SFHGLP) and single-family direct home mortgages. During this time, all pending foreclosures of these loans must stop, and no new foreclosures can start. If you’re not sure whether you have one of these loans, you should contact your loan servicer.

FOR OWNERS OF MANY MULTI-FAMILY PROPERTIES

Fannie Mae and Freddie Mac have announced that multifamily property owners can also get relief from their mortgage payments, but only if they agree not to file evictions against renters who are unable to pay rent due to COVID-19. Again, this only covers mortgages backed by Fannie Mae and Freddie Mac.

Even if you are not covered by these programs, your lender may have programs that can help if you’re having a hard time making your payments. Don’t just stop making your payments. You should reach out to your lender first to see what help is available.

If you are facing foreclosure or if you have been served with any legal papers, you should contact an attorney. The SC Bar Lawyer Referral Service can be reached at (800) 868-2284 and can give you the name of an attorney who may be able to help. If you can’t afford to pay an attorney, you can call SC Legal Services at (888) 346-5592 to see if you qualify for free legal advice or representation.

Updates:

- To help those families still struggling to pay their rent and to help multifamily property owners maintain their properties, FHFA is extending the multifamily COVID-19 forbearance and tenant protections through the end of September 2021.

- Property owners with Enterprise-backed multifamily mortgages can enter a new or, if qualified, modified forbearance if they experience a financial hardship due to the COVID-19 emergency. Property owners who enter into a new or modified forbearance agreement must:

- Inform tenants in writing about tenant protections available during the property owner's forbearance and repayment periods; and

- Agree not to evict tenants solely for the nonpayment of rent while the property is in forbearance.

- Additional tenant protections apply during the repayment periods. These protections include:

- Giving tenants at least a 30-day notice to vacate;

- Not charging tenants late fees or penalties for nonpayment of rent; and

- Allowing tenant flexibility in the repayment of back-rent over time, and not necessarily in a lump sum.

- In addition to requiring written tenant notification, the Enterprises have posted the tenant protections to their respective online multifamily property lookup tool websites. The property lookup tools make it easier for tenants to find out if the multifamily property in which they reside has an Enterprise-backed mortgage.

Immigrants looking for housing for their families in South Carolina may face discrimination from landlords who do not want to rent to immigrants or people who are “undocumented.” This is illegal. Everyone, regardless of immigration status, has a right to be protected from discrimination by landlords, including discrimination based on someone’s immigration status. Below, SC Appleseed has answered some common questions about what to do if you experience discrimination when looking for housing or renting.

1. Can a landlord refuse to rent to me because I’m undocumented?

NO. Federal law prohibits denying housing to someone because of their race or the country they were born in, even if the discrimination is unintentional. A landlord who refuses to rent to people who are undocumented will almost certainly end up denying housing to more people who are Hispanic/Latinx than other races. Because this kind of policy has a discriminatory effect, the landlord may be breaking the law even if they didn’t intend to discriminate.

Here are a few actions that could be illegal:

- A landlord simply refuses to rent to someone who is undocumented.

- A landlord requires a Social Security Number and won’t accept an ITIN as a substitute.

- A landlord requires proof of citizenship or immigration status.

*Note that many federally subsidized housing programs, like public housing or “section 8”, are only available to U.S. citizens or other eligible immigrants.

2.What should I do if this happens to me?

You have at least a couple of options.

First, you may have a legal claim against the landlord that denied you housing. Federal law allows someone who has been harmed by housing discrimination to file a lawsuit to recover damages and to prevent the discrimination from happening to someone else.

Second, you may be able to file an administrative complaint with the United States Department of Housing and Urban Development (“HUD”) or the South Carolina Human Affairs Commission (“SCHAC”). HUD or SCHAC will investigate your complaint and decide if they think that the landlord discriminated against you. They may try and work out a settlement between you and the landlord as well. We would be happy to talk to you about your situation and see if we can help or find someone who can! We have Spanish-speaking staff available and you can reach us at (803) 779-1113 ext 108.

3. Should I be worried about retaliation if I file a lawsuit or an administrative complaint?

No. Federal law prohibits retaliating against someone because they filed a housing discrimination lawsuit or administrative complaint.

4. I’m thinking about moving into a mobile home park where I would be renting the lot and buying the home. Is this a good idea?

Maybe, but be careful. There are several things to think about:

- How old is the mobile home? If it was manufactured before June 15, 1976, then it’s very unlikely that you will be able to legally move it somewhere else. The landlord doesn’t have to rent the land to you forever and you may run into a situation where you won’t be able to live at that mobile home park anymore. If that happens, you don’t want to own a home that you can’t move. Even if you can move the home, it can cost thousands of dollars to do this.

- Can you get title to the mobile home? You want to make sure that whoever you’re buying the home from has the title and that they can put it in your name when the time comes. Without title in your name, you probably won’t be able to move the home. Also, you probably won’t get notice when taxes are due on the home and it could be sold if the taxes aren’t paid.

- Is the seller willing to put this agreement in writing? In many cases, like the sale of a mobile home, a verbal agreement may not be enforceable in court. If you pay for the home and the seller doesn’t give you the title, you want to have a written agreement that you can enforce.

- Does the mobile home need repairs? If you are buying the mobile home, then repairs are your responsibility. If you’re renting it, then your landlord has to maintain it.

5. When can my landlord raise my rent and does the law limit how much they can raise it?

You first have to look at your lease to see if it says anything about when your rent can be increased. Most leases don’t say anything about this. That usually means that your landlord can’t increase your rent during the term of your lease. For example, if you have a lease for one year, your landlord usually can’t increase your rent during that year. If you have a month to month lease, your landlord will need to give you at least 30 days’ notice before your rent increases.

South Carolina law doesn’t put any limits on how much a landlord can increase rent with one exception. A landlord can’t retaliate against you by increasing your rent above the “fair market rental value” just because you complained to them about problems with the property or because you complained to code enforcement. It is also important to make sure you always have proof of how much rent you paid and when you paid it. Even if you pay rent in cash, you can send a text message or email with the amount you paid as proof of payment, in case there is a dispute over payment in the future.

6. I'm worried that if I complain to my landlord about something, they will call ICE.

We hear you. The risk of ICE taking any action against you just because your landlord did this may be smaller than you think, because it is illegal to threaten to report someone to Immigrations and Customs Enforcement (ICE) for trying to assert their rights to safe housing. In fact, if you do encounter ICE after you complaint to your landlord or the authorities about problems with your housing, you should tell ICE that you have a complaint against the landlord, because ICE can decline to take action to deport you if you were reported by your landlord. Each situation is different and we’re happy to talk with you about the issues you’re facing and any concerns you might have about retaliation. We have Spanish-speaking staff available and you can reach us at (803) 779-1113 ext 108.

NOTE: This information applied to the 2019/2020 school year. Please check with your university for updated information for 2021-2022.

Private Student Housing and COVID-19

With colleges and universities closing in response to COVID-19, many students who rent an apartment from a private company off-campus are wondering what this means for their leases. Here are some answers to frequently asked questions. These answers are based on what these kinds of leases normally say. You should read your lease carefully and/or talk with an attorney to see if your situation is different.

- Can I get out of my lease because my school is closed?

MOST LIKELY, NO. Most leases for private student housing do not allow you to get out of them because your school closed. You should check your lease to make sure, though. Right now, no law requires this either. Some leases allow you to get out early by paying a fee. Another option may be finding someone to take over your lease. Obviously, that might be difficult with schools closed. However, you may be able to find someone looking for an apartment that doesn’t attend your school.

- Do I still have to pay rent?

MOST LIKELY, YES. If your lease is still valid, then you have an obligation to pay rent.

- What can happen if I don’t pay rent?

If you owe rent and don’t pay it, a few things can happen.

First, your landlord can file to have you evicted. Some may do this even if you’re not physically in the apartment because they don’t want to risk taking your apartment back without using the legal process. Even if you’re not living in the apartment, having an eviction case filed against you can have consequences. These cases become a matter of public record. Many landlords now check public records themselves or use tenant screening companies to see if someone applying to rent from them has a record of criminal activity or evictions. The fact that an eviction case is filed against you could make it harder to rent in the future.

Second, a landlord who believes you owe them money can report this debt to a credit reporting agency. This can harm your credit and make it more difficult or costly for you to get credit in the future.

Third, a landlord who believes you owe them money can file a lawsuit to try and collect it from you. If they win a lawsuit, they can get a judgment against you. There are exemption laws that prevent someone from taking everything you have to pay a judgment, but you may have property that is not exempt. A judgment also lasts for 10 years, so even if you don’t have much property now, you may in the future. Also, many student apartment complexes ask for or require a student’s parent or guardian to sign something saying that they will be responsible for any money that is owed. This means your parent or guardian may be on the hook as well.

- So, what should I do?

First, talk to your landlord. You may be able to work something out that is fair for everyone.

Second, talk to an attorney. They can help you understand your situation and may be able to help work something out with your landlord. The South Carolina Bar Lawyer Referral Service – (800) 868-2284 – can give you the name of a lawyer who may be able to help. If you can’t afford to pay an attorney, you can call South Carolina Legal Services at (888) 346-5592 or APPLY ONLINE to see if you can get free legal advice or representation.

If you are enrolled at the University of South Carolina Columbia Campus, you may be able to get free legal help through their Student Legal Services Office.

Consumer Protections

At this time, it may be tempting to take out a loan to make ends meet. There are lenders out there that will make it very easy to get the loan. The problem is that paying back the loan will not be so easy, especially when your income may be cut back or off.

Take steps like applying for Unemployment Insurance, SNAP, TANF or contacting charities. But do not borrow from lenders that promise easy borrowing like payday, title, or high-cost consumer finance loans. Though this is akin to a national disaster, the long-term costs of these loans outweigh the short-term benefits.

In this time of economic uncertainty and restlessness, scammers are preying on people’s fear and lack of information. Here are some ways to avoid scammers:

- Do not talk with companies or out-of-state lawyers that offer to remove or cut your debts by talking with your creditors. These businesses often collect large fees. They get few settlements with your creditors. This will leave you deeper in debt.

- Never pay upfront fees for debt settlement services. Avoid any company that charges a high fee (such as 20 percent of your debt) to settle your debts.

- Avoid debt consolidation offers that would ask to use your home to get the debt. Creditors may offer to merge your debts through a second mortgage or a home equity line of credit. Remember that these loans want you to put up your home as collateral. If you can’t make the payments or if your payments are late, you could lose your home.

- Stick to reliable sources to manage your debt. You should always watch out for uninvited offers. Before you do business with a company always get a second opinion before you sign a loan or to refinance your debt.

- Contact your creditors directly to talk about options for repayment. Look for help. You can find an accredited, non-profit credit counselor in your area by contacting the National Foundation for Credit Counseling at 1-800-388-2227 or nfcc.org.

- Learn more about what credit counselors can charge for their services. Finally, if your debt is large, consider contacting a local bankruptcy attorney in your area to look at whether bankruptcy may be an option for you.

If you are low income, you may be eligible for help through SC Legal Services. https://sclegal.org/

Governor McMaster asked utility companies to stop disconnections for the coronavirus state of emergency. While you will not be cut off right now, you may be charged late fees by the provider. Contact your provider or visit the SC Office of Regulatory Staff (SCORS) website for more information.

SC Stay Plus Program

People who qualify can get up to 12 months of aid for rent or utility bills that date back to March 2020. They can also qualify for up to three months of future rental assistance. SC Stay Plus Program opened for new applications in May 2021.

For a household to qualify, one or more individuals must meet all of the following criteria:

- Has qualified for unemployment or experienced a reduction in household income;

- incurred significant costs, or experienced a financial hardship directly or indirectly due to COVID-19 (since March 2020);

- can demonstrate a risk of experiencing homelessness or housing instability;

- has a household income at or below 80% of the county median income.

The program is open to residents in 39 SC counties. Residents in Anderson, Berkeley, Charleston, Greenville, Horry, Richland and Spartanburg counties should reach out to their local county offices for programs in their area or consult the list of available programs on SC Housing’s Resources for Renters page.

More information: https://schousing.com/home/sc-stay

Apply here: https://schousing.com/home/SC-Stay-Plus

South Carolina is no longer under a state of emergency as of June 7, 2021, thus price gouging is no longer illegal. It is important to stay mindful of scams in general after natural disasters as some businesses and people may take advantage of the vulnerable situation through a number of tactics including contractor fraud and abuse and online scams.

While the emergency is in effect, it is against the law for a business to charge higher prices for things just because there is an emergency. This is called price gouging and it is illegal. If you think a business is price gouging, you can file a complaint.

To file a complaint, you will need to report the time and date of the incident and the name and address of the business and the price they were charging. You can email your complaint and any supporting pictures or documents to [email protected] or call 803-737-3953 and leave a message. You can also file a complaint with the South Carolina Department of Consumer Affairs by calling 1-800-922-1594 or by going to this website. If you have problems filing a complaint with the State agency, please contact SC Appleseed Legal Justice Center at 803-779-1113 or [email protected].

Canceling your Reservation? Here's What To Know

Due to the end of the emergency order, this information is subject to change. “Consumers are not automatically entitled to a refund or credit if they decide to cancel their reservations. There is no state law requiring businesses to provide full refunds when a State of Emergency has been declared.”

Scammers have added a new tactic, which promises to mail customers refund checks for overpayments on their accounts if they can confirm their personal data, including birthdays and, in some cases, social security numbers.

Generally, Duke Energy and subsidiary Piedmont Natural Gas will apply refunds as a credit to customers’ accounts and will not contact customers to verify personal information by phone, email or in person to mail a check. Scam reports also indicate that phone scammers posing as utility providers continue to call and insist customers are delinquent on their bills. The scammer typically claims a service disconnection is pending, rigs caller ID to mimic your utility provider, and demands an immediate payment in the form of a prepaid debit card.

There is a Spanish language WhatsApp message scam reported in South Carolina. The WhatsApp message is titled "Recibe Ayuda Alimentaria" and says people can receive government benefits, even if they are undocumented immigrants, by clicking a website link. This WhatsApp message and link are a scam and this government program does not exist. Please report suspected COVID-19 scams and fraud by calling the National Center for Disaster Fraud (NCDF) hotline (1-866-720-5721) or to the NCDF e-mail address [email protected].

Update: 8/13/21

- Dominion Energy no longer promises not to disconnect due to COVID 19 complications, but is still encouraging customers to look into payment options, assistance programs and payment arrangements that can help pay for utilities.

- Duke Energy also no longer promises not to disconnect due to COVID 19. However, they too want to help provide relief and support. Duke Energy has relaxed usual timelines for payment arrangements. You may request an extension on your payment due date; or set up an extended payment arrangement on any past-due balance. If you need additional time to pay, please consider taking advantage of these payment options.

- List of contacts for rent and utility assistance programs: https://sclegal.org/rental-assistance-chart/

Scams

Many scams have been reported claiming to be an attempt to collect payment for past due utility bills. The scammers claim utility service will be cut off if the bill is not paid. They will also often offer to settle the bill for a less, if the bill is paid immediately over the phone, and require the reduced amount to be paid by gift card. This is a scam.

Utility companies in South Carolina are encouraging all customers, “If you get a call and you are suspicious, just hang up and call the number on your bill.”

All scams and attempted fraud should be reported to the SC Department of Consumer Affairs https://www.consumer.sc.gov/about-us/contact-us or by calling 844-835-5322.

Legal & Other Resources

Charleston Legal Access (CLA):

CLA is open and operating while practicing social distancing measures. CLA’s office is open. Their intake line is open for both in-person and online to provide advice, counsel, and consultations via phone or video conferencing. They are accepting new clients, and will handle cases on civil matters including housing, civil rights, elder law, consumer rights, and benefits.

Clients are eligible for our services if their income is between 125% and 400% of the federal poverty guidelines. CLA serves Charleston, Dorchester, and Berkeley counties. Their intake hours are 9-5. For assistance, call 843-640-5980 or contact them at http://www.charlestonlegalaccess.org/contact.

CHARLESTON PRO BONO LEGAL SERVICES INC.

Phone: 843.853.6456

Charleston Pro Bono Legal Services is open and operating while implementing social distancing practices as requested by government and health officials. Our office is actively fielding phone calls, applications, and handling appointment via telephone or video conferencing. If you have an appointment scheduled, we will be contacting you to arrange an appropriate alternative to face-to-face contact. You may continue to contact our office by telephone and email. We will be responding to all messages in due course. Thank you for your patience and cooperation as we continue with our best efforts to assist with your legal needs during this time of emergency.

Second Chance Justice Collaborative:

During this time of uncertainty surrounding the coronavirus, the Second Chance Justice Collaborative is accessible and available to help deal with criminal justice system-related legal issues that may arise. Their physical office is closed due to the outbreak, but will be available by phone (864-272-0681, ext. 1004) and email ([email protected]).

Please don't hesitate to reach out. Issues they can help with include getting ID, voting rights, public benefits, housing, employment, court-ordered debt, education, parole and probation issues, and expungements and pardons.

South Carolina Bar Pro Bono Program

This program can try and find you a pro bono attorney if you are very low income. You may call (803) 799-4015 or (800) 395-3425 to see if you are eligible for help. You may also ask a question through https://sc.freelegalanswers.org. There are no income restrictions to use this on line service

South Carolina Legal Services:

Update: offices are now open. South Carolina Legal Services is committed to meeting the needs of South Carolinians during this critical time.

New applicants can apply for legal help by calling our statewide intake office at 888-346-5592 or online at www.lawhelp.org/sc/online-intake. The intake line is open Monday through Thursday from 9:00 a.m. to 6:00 p.m.

Existing clients can contact their local office. Local office contact information can be found at www.sclegal.org/locations. For all out inquiries, please visit www.sclegal.org.

We apologize for any inconvenience. Be safe.

SC Protection and Advocacy for People with Disabilities.

Update: offices are now open. Due to COVID-19, and the need to keep our staff and the people we serve safe, P&A is making some changes to our operations. Our staff are working remotely, but are still available by phone and email for people who have questions and concerns. Our information and referral phone lines are open, and staff are working to organize resources that people may need. Please see the new resource page on our website that has information you may need, and do not hesitate to call us. We are here for you!

Toll-free 1-866-275-7273

Email: [email protected]

Monday-Friday 8:30 a.m.-5:00 p.m.

Follow us on: Facebook and Twitter

Social distancing and staying at home are important to prevent the spread of the COVID-19 virus and some people may be required to stay home. This can put people living with an abuser in danger. Here are some resources if you or a loved one is facing abuse:

- National Domestic Violence Hotline: 1-800-799-7233 or if you’re unable to speak safely, you can log onto www.thehotline.org or text LOVEIS to 22522

- National Sexual Assault Hotline: 1-800-656-4673 or by chat at: https://www.rainn.org/ or https://www.rainn.org/es

- National Child Abuse Hotline: 1-888-227-3487 or report abuse in South Carolina by finding your county at https://dss.sc.gov/contact/

- The South Carolina Coalition Against Domestic Violence and Sexual Assault (SCCADVSA) has a video in Spanish explaining how victims of sexual assault and domestic violence in South Carolina can get local help in Spanish. *To see SSCADVASA’s website in another language, click on “Translate” on the upper right corner. Click on “Select language” in the box that appears in the middle screen and then select “Spanish” or your language.

South Carolina Coalition Against Domestic Violence and Assault’s (SCADVASA) Local Resources:

- Sistercare’s 24/7 crisis line remains open. They normally provide shelter and support services in Richland, Lexington, Kershaw, Newberry, and Fairfield counties for survivors and their children. They have staff/volunteers that are fluent in Spanish. You call them at 803-765-9428.

- Sexual Trauma Services of the Midland’s offices are now open along with their crisis line. They provide support services for survivors in Clarendon, Lexington, Newberry, Richland and, Sumter County. They have staff/volunteers that are fluent in Spanish. You can call at 803-771-7273.

- Palmetto Citizens Against Sexual Assault - Please note, some of the county staff are still working remotely. If you have trouble reaching one of our centers, please contact the Florence County Sexual Assault and Family Violence Center at (843) 669-4694. They can also be reached at their 24-hour hotline number 803-286-5232. They normally provide direct services to victims of sexual abuse, and interpersonal violence in Chester, Fairfield, and Lancaster County. They have staff/volunteers that are fluent in Spanish.

- The Peedee Coalition Against Domestic and Sexual Assault is working remotely but can be reached at their 24-hour hotline number at 1-800-273-1820. They provide services to victims of sexual assault, domestic violence, and child abuse in Chesterfield, Darlington, Dillon, Florence, Marion, Marlboro, Sumter, and Williamsburg County. They have staff/volunteers fluent in Spanish and Tagalog.

- CASA Family Systems provides support, advocacy, and intervention to individuals and families who have been affected by sexual assault, family violence, and/or child abuse and neglect in Bamberg, Calhoun, and Orangeburg County. Interpretation may be available. They can be contacted at their emergency hotline at (803) 534-2272 OR (803) 531-6211 and at their toll-free number at (800) 298-7228.

- Hopeful Horizons is a children's advocacy, domestic violence and rape crisis center that works to create safer communities by changing the culture of violence and offering a path to healing. The organization provides safety, hope and healing to survivors of child abuse, domestic violence and sexual assault through evidence-based practices, outreach, prevention and education. We serve Beaufort, Allendale, Colleton, Hampton and Jasper counties. 24-Hour Support Hotline: (843)-770-1070

- Safe Harbor is a non-profit organization that offers free and confidential services. Their mission is to provide services to victims of domestic violence and their children and eliminate cultural acceptance of domestic violence through coordinated community response, education, and prevention. A 24/7 help line is available at (800) 291-2139. Safe Harbor serves the Upstate counties of Greenville, Anderson, Pickens, and Oconee. There also have shelters available in Greenville, Anderson, and Oconee. The Shelter Program is for women, people who identify as women, and their children who are experiencing immediate danger due to domestic violence. Safe Harbor provides services for all genders. Their services include counseling, child and family counseling, case management, and helps with orders of protection. For Spanish speakers, there is an option on the Safe Harbor website that will translate all of the information into Spanish. Below is a video that further explains the services and COVID-19 precautions Safe Harbor staff is taking.

SCVAN is launching a new website- www.scvanlegal.org- making it easier for victims to apply for services and also providing information and statewide resources for survivors of crime- including information specific to COVID-19. These materials are also available in Spanish. The website also includes training and educational materials for service providers, attorneys, and community partners, and creates space for service providers to connect with each other. It also includes a directory with comprehensive local, statewide and national resources for all South Carolina- such as courts, law enforcement, health care, and more.

From SCVAN Press Release: